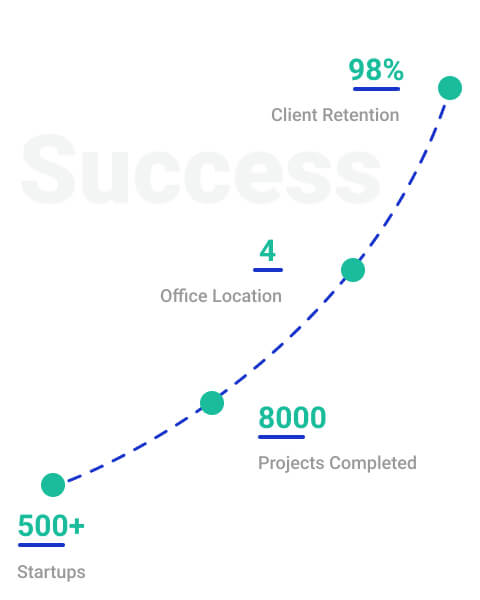

Starting a Business

Starting a business is exciting undertaking filled with possibilities. It is a chance to live your passion makes it into a profitable venture giving a meaningful impact. With the right mindset, perseverance, and a well-executed plan, you can create a thriving business that will fulfil your dreams and also meets the needs of your customers. Therefore, Embrace innovation, embrace your vision, and embrace the opportunities with the experts at Startupfino.

Intellectual Property Rights

Intellectual Property rights have an important role in protecting innovation, creativity, promoting competition, and maintaining economic prosperity. It is important to understand that the requirements for IPR that can vary depending upon the jurisdiction and the specific laws governing intellectual property. It is advisable to consult with Startupfino legal experts or professionals to understand the specific requirements and procedures applicable to your situation.

Government Registrations

When you start a business, there are various government registrations and licenses which will be needed depending on the nature and type of your business. In case you fail to comply with complusory registrations and licenses then you have to face fines, penalties, and other legal consequences. Therefore, Sartupfino helps in government registrations and licenses to ensure legal compliance and protect the interests of all parties involved.

Legal Documentation

It is compulsory to have proper legal documentation especially when starting and operating a business. Legal documentation helps establish the legal framework, rights, and responsibilities of the business and its stakeholders. At Startupfino legal professionals or business advisors ensure that you have the necessary legal documentation tailored to your specific business needs and local laws. This may include licenses, permits, certificates, safety manuals, environmental impact assessments, or industry-specific compliance documents.

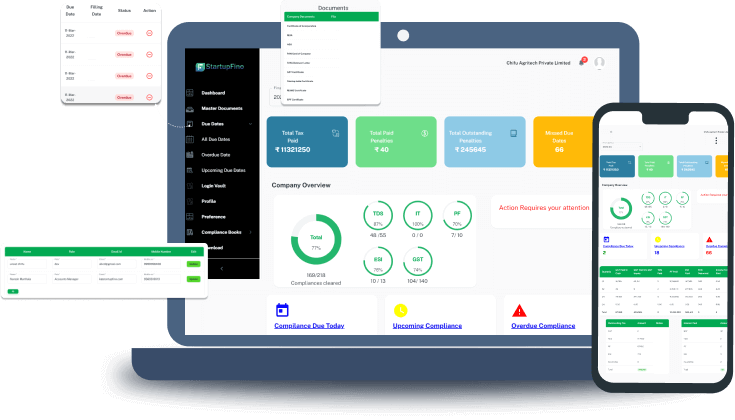

Mandatory Compliance

Mandatory compliance refers to the legal obligations and requirements that businesses must fulfil in order to operate within the boundaries set by regulations, laws, and governing bodies. These compliance obligations must be maintained to ensure the safety, fairness, and integrity of business practices and to protect the interests of various stakeholders. Hence, Startupfino keeps you informed about the applicable laws and regulations and also guide you take the necessary steps to meet the compliance obligations.

Need for Lawyers

Businesses must comply with various laws and regulations at the local, state, and national levels. Lawyers help businesses understand and navigate the legal requirements specific to their industry and jurisdiction. When starting a business, lawyers provide guidance on the most suitable legal structure. They ensure that businesses operate within the boundaries of the law, reducing the risk of legal issues, penalties, and fines. Startupfino lawyers� team can provide valuable legal expertise, help mitigate risks, and ensure that your business operates within the bounds of the law.